Company

- Home

- About us

Listings

- Summary of listings

- Elfrida Farm

- Dateland Tract-SOLD!

- Bouse Organic - SOLD!

- Taylor Dairy- SOLD!

- Benson Land- SOLD!

- Holbrook Ranch - SOLD!

- Greater AZ Farm - SOLD!

- Squaw Crk Ranch -SOLD!

- J&K Organic Farm -SOLD!

- White House Rnch- SOLD!

Services

- Brokerage

- Appraisals

- Site Selection/Assembly

- Market research

- Property Tax Analysis

- Water rights

- Mapping/GIS

Members

- Steve Pendleton

- Mack McKeon

Careers

- Appraisal & Real Estate

News

- Blog/RSS ![]()

- Member login

Property Tax Analysis

You may be paying too much in property tax - especially if you have recently purchased a large tract of land in Pinal or Maricopa County.

Southwestern Ag Services can provide the following services:

- Review and analyze property assessment with a comprehensive database of sales combined with an extensive GIS mapping system

- Verify current property classification

- Utilization of production agriculture to help establish, maintain, or verify the ag classification on your property.

Comments

With the current depressed real estate market in Pinal County and Maricopa County farming areas it is imperative to reduce holding cost and generate cash flow to help offset these cost. One of the easiest ways to accomplish this goal is by maintaining the Agricultural Status on your property. In Arizona, property that is classified as agricultural is valuated based the income derived from the agricultural production and not the actual property value. This valuation is typically significantly less than the valuation for a non-agricultural parcel and thus the property taxes are correspondingly lower. With the rapidly changing market in the mid 2000’s many parcels were reclassified to classifications that significantly increased the assessed value. This reclassification generally occurred when the property changed ownership and the proper documentation was not filed or if a property was not actively farmed for several years. We can assist property owners in filing the proper documentation and supporting documents to establish or reestablish an Ag classification or provide guidance in management to support an Ag Classification.

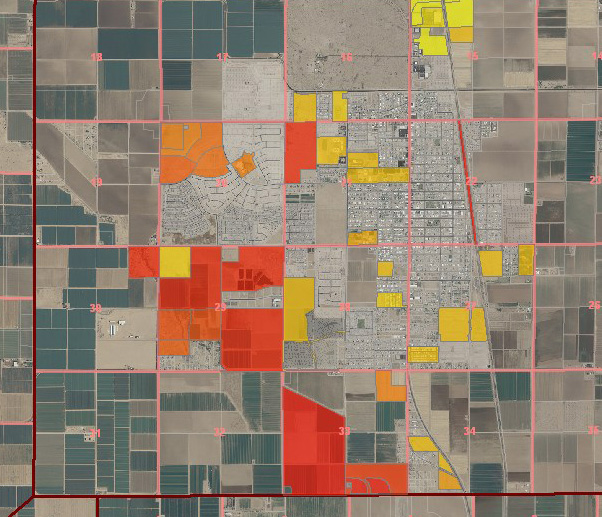

The map above shows larger parcels in a farming area. The parcels without any shading are typically at the lower end of the range of assessed values on a per acre basis. These parcels are generally classified as agricultural. The darker the shading on the parcels the higher the assessed value on a per acre basis. This can be caused by many factors including improvements, land use, etc. However in many cases farmland is not properly classified which can result in an inflated assessment and in turn higher property taxes. We can use these tools to identify these discrepancies and address the problem.

The following is a link to the Arizona Agricultural Property Manual from the Arizona Department of Revenue:

http://www.azdor.gov/Portals/0/Brochure/AZ-Agricultural-Property-Manual.pdf

We can also review your Assessed Valuation and make comparisons with Current market data to determine if Assessed Values are consistent with current Market Values. If a discrepancy is uncovered, Southwestern Ag Services can assist in filing an appeal with the County Assessor and provide support and documentation substantiating the appeal.

Please contact us and we’ll be happy to review your current status and make recommendations

Steve Pendleton or Danielle Bechtel

(480) 569-2671 or steve@swaservices.com or danielle@swaservices.com